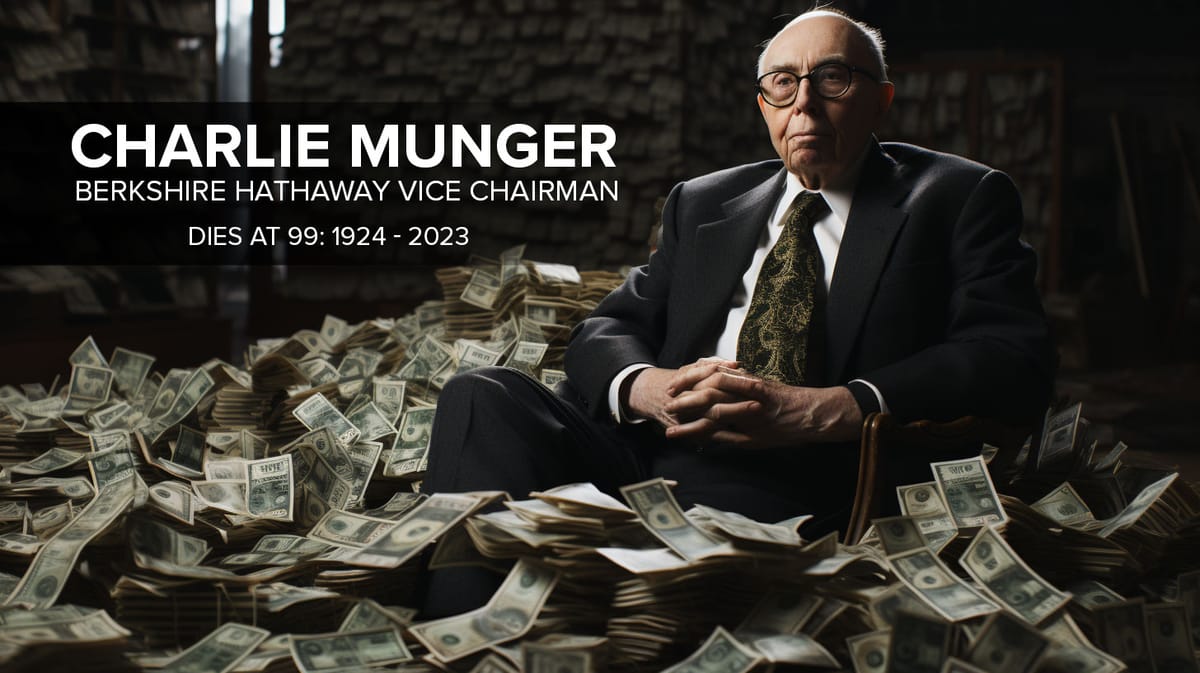

Charlie Munger, the ‘Abominable No-Man,’ and Warren Buffett’s Partner Dies at 99

Charlie Munger: A Legacy of Wisdom and Success

Explore the life and accomplishments of Charlie Munger, the legendary vice chairman of Berkshire Hathaway, and his profound impact on the investing world. Featuring real quotes from prominent figures, this article celebrates the enduring legacy of a remarkable individual.

Munger's life was a testament to resilience and perseverance. In 1953, at the age of 29, he faced a series of personal hardships, including a divorce and the tragic loss of his young son. Despite these challenges, Munger demonstrated remarkable fortitude, refusing to succumb to despair.

Enduring Legacy

Munger's influence extended beyond his partnership with Warren Buffett. His wisdom and inspiration were instrumental in the success of Berkshire Hathaway, a company that grew into a giant holding with a market capitalization of $700 billion. Buffett himself acknowledged Munger's pivotal role, crediting him with pushing beyond early value investing strategies to buy great businesses at good prices.

Philanthropy and Diverse Interests

George Seay, chairman of Annandale Capital, described Munger as "a brilliant attorney" and emphasized his diverse accomplishments beyond investing, including his work as a real estate attorney, publisher of the Daily Journal, and his involvement in architecture and philanthropy

Munger's contributions were not limited to the realm of investing. He was a philanthropist, making significant gifts to various educational institutions and charities, including Harvard-Westlake, Stanford University Law School, the University of Michigan, and the Huntington Library. Moreover, Munger's passions extended to real estate, architecture, and serving on the board of Costco Wholesale Corp.

Tributes from Prominent Figures

Mario Gabelli, chairman and CEO of GAMCO Investors, described Munger as "a titan" and emphasized the profound impact of his passing.

Warren Buffett once credited Munger as the ideator behind the business approach of Berkshire Hathaway, saying Munger once advised him with a "blueprint" to "buy wonderful businesses at fair prices" rather than vice versa.

Mohamed El-Erian, chief economic advisor of Allianz, spoke about the uniquely powerful relationship between Munger and Warren Buffett, highlighting their collaborative prowess and common sense.

Wisdom, and enduring legacy

Charlie Munger's life and accomplishments stand as a testament to the power of resilience, wisdom, and enduring legacy. His profound impact on the investing world and beyond will continue to inspire generations to come. This article celebrates the life and accomplishments of Charlie Munger, offering a glimpse into the enduring legacy of a remarkable individual. Through real quotes and insights, it captures the essence of Munger's wisdom and success, paying homage to his profound impact on the investing world.

What were Charlie Munger's key contributions to Berkshire Hathaway?

Charlie Munger played a pivotal role in the growth of Berkshire Hathaway into a giant holding company with a market capitalization of $700 billion

What was Charlie Munger's approach to problem-solving?

Munger emphasized answering the most obvious questions first as a problem-solving strategy.

What was the significance of the "Friday lunch club" in Charlie Munger's life?

Business and financial leaders made frequent pilgrimages to Los Angeles to hear Charlie Munger’s thoughts as he held court while peering through thick eyeglasses over high, rosy cheekbones.

How did Charlie Munger's wisdom impact Warren Buffett?

Warren Buffett credited Munger with pushing beyond early value investing strategies to buy great businesses at good prices, broadening Buffett's approach to investing.

What was Charlie Munger's educational background and other interests?

Munger studied mathematics at the University of Michigan in the 1940s, but dropped out of college to serve as a meteorologist in the Army Air Corps during World War II. His passions extended to real estate, architecture, and serving on the board of Costco Wholesale Corp.