Midweek Market Update - Nov 1

Some big assay results from AEMC.V and BWCG.V this week, Greg Beischer Webinar and Q&A today at 4 PM ET, FOMC meeting at 2 p.m. ET, VERSES AI set to demo Genius™ platform Nov 3rd

- Some big assay results from AEMC.V and BWCG.V this week

- Greg Beischer Webinar and Q&A today at 4 PM ET

- FOMC meeting at 2 p.m. ET

- VERSES AI set to demo Genius™ platform Nov 3rd

- Biden Issues Executive Order on Safe, Secure, and Trustworthy Artificial Intelligence

Busy day with the November 1st FOMC meeting at 2 p.m. ET, they are highly likely to keep interest rates unchanged at the current 5.25-5.50% range. If you're looking watch something a little more engaging, check out the Radius Research interview with Greg Beischer👇 Link Below

MAJOR NEWS

VERSES announces its first of 10 Genius Partners, NALANTIS is a next-gen language technology company that developed an artificial intelligence system that enables machines to understand text and natural language.

Genius™ platform World Premier Demo - Nov 3rd

Register below to see history in the making as they unveil Genius™ to the world. 🥳👇 Register Below

RESOURCE MARKET UPDATES

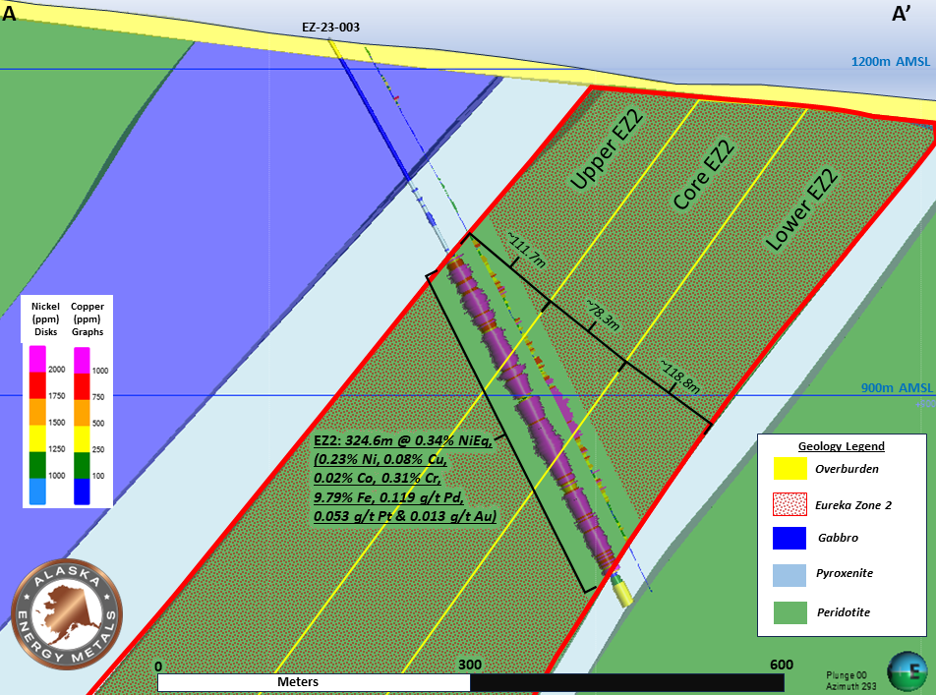

4 holes down - 4 to go until they can calculate an Inferred Resource.

Every target has been met or exceeded and getting closer every day to estimated Billion+ pounds NiEq!

Golden Triangle Strikes again!

Blackwolf releases assay results at the Harry Property - Significant New Discovery! First Assays received hit two bonanza grade gold zones in the same drill hole (BWCG.V)

Battery Metals / EV Markets

AI | ARTIFICIAL INTELEGENCE

Here is a detailed market update for November 1, 2023:

Overview

- US stock futures slipped and Treasuries edged higher ahead of the Federal Reserve's policy decision today.

- Asia stocks gained broadly, led by Japanese stocks. Hong Kong and China gauges underperformed after weak economic data.

- Treasury yields inched lower ahead of the Fed meeting. The benchmark 10-year yield is around 4.05%.

- The yen strengthened from near its weakest level this year after Japan's foreign exchange chief warned of possible intervention.

US Markets

- S&P 500 futures edged 0.2% lower after the index rebounded 1.2% yesterday.

- The S&P 500 posted its first back-to-back gains in 3 weeks on Tuesday.

- Investors are awaiting the Fed's policy decision and Chairman Powell's press conference today. The Fed is expected to raise rates by 75 basis points.

- Key US economic data due this week: October jobs report on Friday.

Global Markets

- MSCI's Asia Pacific index rose 0.8%, led by a 1.8% jump in Japan's Topix index.

- Hong Kong stocks fell 0.3% while China's CSI 300 pared gains to 0.2% after weak manufacturing data.

- European stocks looked set to open higher, with the Stoxx 50 futures up 0.6%.

Commodities

- Oil prices edged higher, with Brent crude up 0.3% to $94.80/barrel.

- Gold prices were little changed at $1,644/ounce.

Earnings Reports

- Key companies reporting earnings today: CVS Health, Humana, Thomson Reuters, Apollo Global Management, Trane Technologies, Seagen, Kraft Heinz.

The markets remain volatile ahead of the Fed decision today. However, improved economic data and earnings could support stocks over the medium-term.

What to Expect Today

The Federal Reserve is expected to leave interest rates unchanged at its policy meeting today. This would mark the second consecutive meeting at which the central bank opted to skip another rate hike in the current policy-tightening cycle.

Investors will be keenly focused on the committee’s statement, released at the meeting’s conclusion, and on Chair Jerome Powell’s comments in a press conference this afternoon. Chiefly, markets will seek clues to the Fed’s rate-hike decision in December, at its last meeting of the year.

Thanks for making this far! Have a great day