Six Reasons RUA Gold Stands Out!

- Worlds Premier Mining Friendly Expedited Permitting Jurisdiction

- Holds New Zealand’s Largest Antimony Critical Metal Deposit

- Possible Further Accretive M&A Activity

- Management with Track Records of Building Billion Dollar Companies

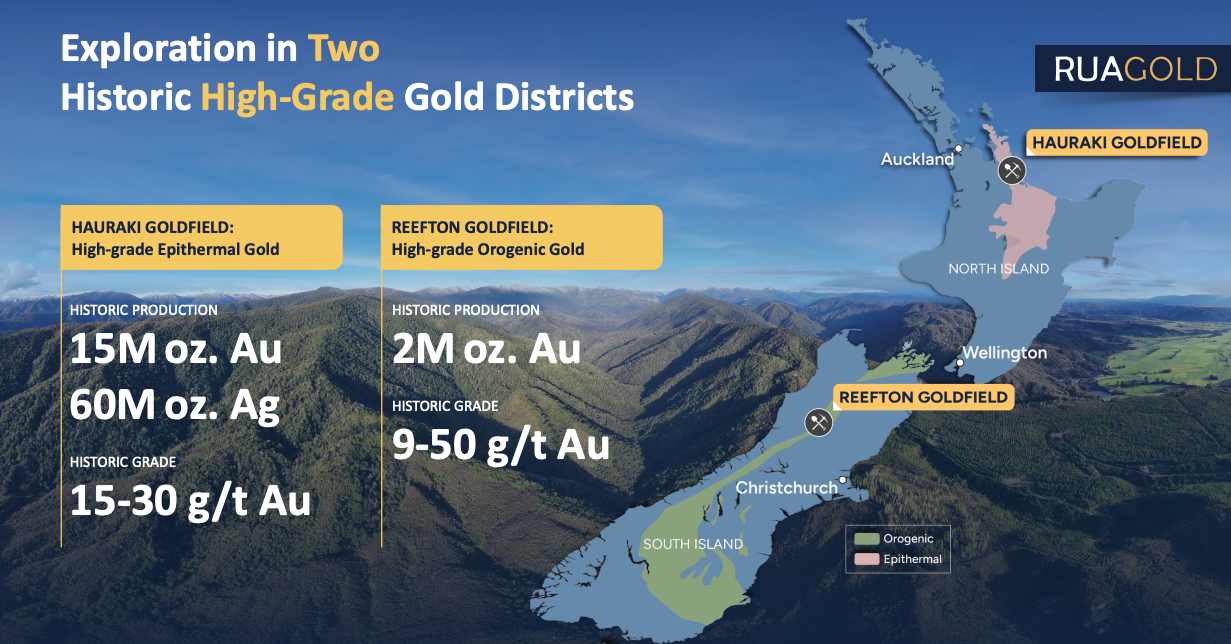

- Consistent High-Grade Gold Intercepts Surrounded by Extensive Past Production

- Oversubscribed Financing with No Warrant and Over 20% Insider Participation

RUA Gold Inc. (TSXV: RUA, OTC: NZAUF, WKN: A40QYC) is fast becoming a dominant explorer in New Zealand’s historic Reefton Gold District, powered by strategic acquisitions, impressive drill results, and a compelling growth story. As well the Company just closed an oversubscribed $5.75M financing, completed without a discount to market or warrants. This funding rarity clearly demonstrates RUA’s strong institutional backing and insider confidence, with management and directors contributing over 20% of the raise.

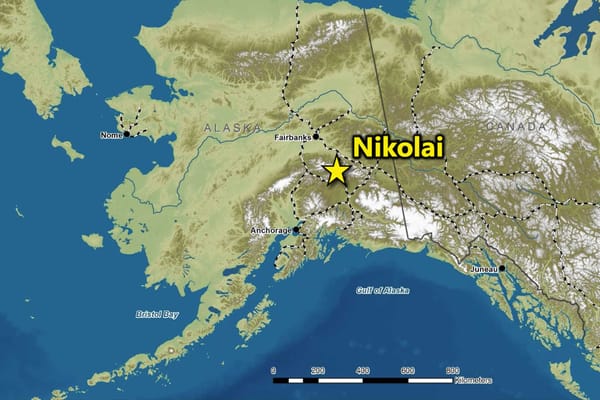

Location, Location, Location

Yes, the Reefton District has a long history of high-grade gold production, but more interestingly, New Zealand recently triggered an aggressive mandate to double the country’s mining exports by 2035 becoming one of the world’s friendliest jurisdictions for mineral exploration. The country’s Fast Track Approvals Act 2025 puts the key in the door for junior miners seeking to develop critical mineral projects, such as RUA’s high-grade antimony resource, reducing the often-arduous permitting process from years to 6 months.

Antimony – Mystery Miracle Mineral

Antimony is only produced in a few countries and with growing geopolitical tensions involving China and Russia, not to mention the ethical conflicts of mining in Myanmar, demand is outpacing supply, sending prices to all-time highs. As a little-known yet essential element in electronics, energy storage, pharmaceuticals, and military applications, it isn’t hard to understand why antimony has been recognized as a critical mineral by the US, EU, UK, Japan, Canada, Australia and most recently, New Zealand.

This fact significantly adds to RUA Gold’s value proposition as recent drill results confirmed the junior explorer as the proud owner of New Zealand’s largest antimony resource. These latest assays from Auld Creek revealed some fantastic intersections, including 12m @ 12.2g/t AuEq (1.9g/t Au & 2.4% Sb) and 8m @ 13.2g/t AuEq (2.2g/t Au & 2.2% Sb). Rua Gold could very well insert itself as an invaluable cog in the antimony global supply chain.

M&A Battle for Control of the Reefton District

RUA Gold’s C$18M acquisition of Siren Gold’s assets has cemented its position as the dominant player in the Reefton District. However, Federation Mining attempted to oust Rua Gold twice and failed, signaling how crucial these assets are to their own strategy.

With over US$150M already invested, Federation now needs another deposit to make its project viable—and RUA Gold holds the missing piece. What will happen next? Will RUA Gold acquire Federation, or will Federation acquire RUA Gold? This rare M&A play possibility adds even more to Rua’s investment thesis.

A Management Team Built for Major Development

RUA Gold’s leadership team is packed with proven mine builders. Paul Criddle, the company’s leading technical director, is the CEO of a A$3B+ gold producer and has successfully built five mines—on time and under budget. Federation’s team is equally strong, with former executives from Evolution Mining (A$10B market cap) who have a track record of executing and financing large-scale projects.

Federation has a fully permitted project and well into the development phase, an 80-person workforce, and deep community ties, making the Reefton District an attractive location for a high-grade mining hub. With two industry-leading executive teams in the mix, this jurisdiction is attracting some of the world’s finest talent.

A Well Funded Exploration and M&A Story

With capital secured, RUA Gold is not just another junior explorer—it’s an active contender in a high-stakes corporate battle. The company’s upcoming drilling at Cumberland, targeting historically high-grade gold veins, will strengthen its strategic hand even further.

For investors seeking exposure to high-grade gold, critical minerals, and a potential M&A ultimatum, RUA Gold seems to be holding all the cards in the Reefton District’s unfolding gold and antimony consolidation.

RUA Gold: https://ruagold.com/

Disclaimer

Clarification of Abbreviations: This disclaimer contains the following abbreviations. Omni8 Communications Inc. (DBA: Omni8 Global) herein referred to as “Omni8”, is the owner of the following publications and distribution sources: Financial Gambits website; The Gambit videos; The Gambit podcasts; associated Gambit social media accounts and the Financial Gambits email newsletter. Omni8 publishes and distributes written, video, and audio content by way of, but not limited to, email and SMS distribution, publishing on websites, digital avenues such as display/native/search marketing, retargeting, social media, content distribution services, influencers, direct mail, push notifications and television advertisements herein referred to collectively as “Gambits Content”.

Conduct your own due diligence: The views and opinions regarding the Companies featured in Gambits Content are it’s own views and based on public information such as the Company ‘s website, corporate presentation and materials and the Company’s public filings. This information has been researched independently and is assumed to be reliable and accurate. You should never base any trading decisions solely off Gambits Content. Omni8 aims to provide its audience educational Company information and investment themes but they are not to be considered investment recommendations. The ideas and Companies featured could be speculative in nature and you could lose your entire investment. The companies mentioned are generally earlier stage with a higher risk that can contain an elevated likelihood of volatility, therefore consult a licensed investment advisor and do your own thorough due diligence. Omni8 is not a registered broker dealer, investment advisor, financial analyst, investment banker or other investment professional and does not perform market making activities. No statement or expression of any opinions contained in Gambits Content constitutes an offer to buy or sell securities of the Companies mentioned herein.

Consideration for Services: At the time of the Gambits Content creation and distribution on RUA Gold, Omni8 does not have an investor relations marketing contract in place with the Company. Omni8’s coverage of RUA Gold is featured editorial due to our belief in the Company’s fundamentals and as informational content for our audience and solely the opinion of Financial Gambits and it’s content creators. On March 21,2025 Omni8 was reimbursed $2,000(CAD) by RUA Gold for the costs of creating and distributing the RUA Gold Gambit Content, Due to the fact Omni8 has been compensated for it’s costs, this could still produce an inherent positive bias in our coverage of the Company. At the time of creation and distribution of Gambit’s Content, Omni8 nor it’s principals possess an equity position in the Company but may acquire or dispose of one at any time permitted under securities regulations without further notice.

Omni8 Global’s full disclaimer can be found here:

https://financialgambits.com/disclaimer/

For further information on RUA Golds technical information mentioned in the Gambit’s Content, please thoroughly review the following news releases and disclosures: https://ruagold.com/news/